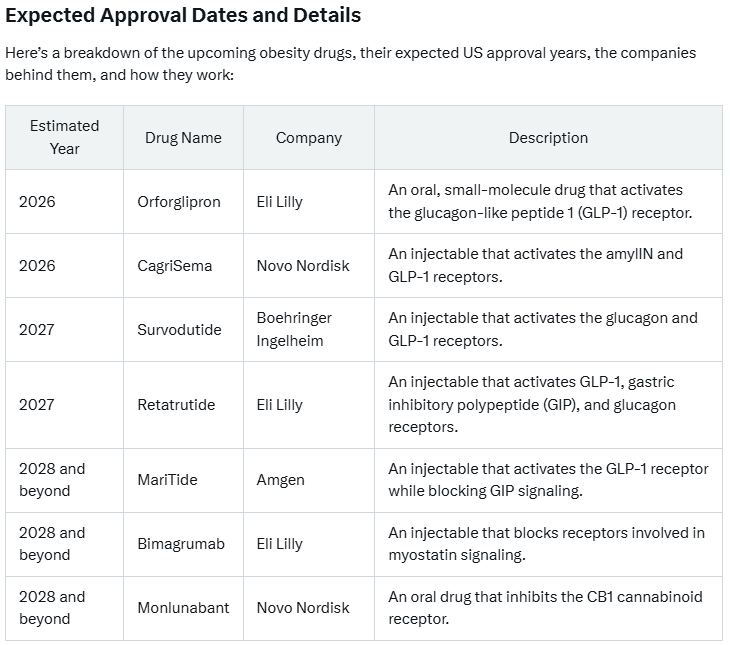

The fight against obesity is entering an exciting new era. With blockbuster drugs like Wegovy (semaglutide) and Zepbound (tirzepatide) already transforming weight management, pharmaceutical giants are racing to develop next-generation therapies. The pipeline includes oral alternatives, multi-targeted injectables, and novel mechanisms that could redefine obesity treatment. Here’s a breakdown of the most anticipated drugs—and when they might hit the U.S. market.

2026: The Year of Convenience and Combination Therapies

1. Orforglipron (Eli Lilly)

- What it is: A daily oral pill that activates the GLP-1 receptor, mimicking hormones that regulate appetite and blood sugar.

- Why it matters: As the first oral GLP-1 agonist for obesity, it could replace injectables for many patients, boosting accessibility and adherence.

2. CagriSema (Novo Nordisk)

- What it is: A once-weekly injectable combining semaglutide (a GLP-1 agonist) with cagrilintide (an amylin analog).

- Why it matters: This dual-action drug targets both appetite (via GLP-1) and satiety (via amylin), potentially outperforming single-mechanism drugs.

2027: Triple-Targeted Agonists Enter the Arena

1. Survodutide (Boehringer Ingelheim)

- What it is: A weekly injectable activating GLP-1 and glucagon receptors.

- Why it matters: Glucagon activation may boost metabolism and fat burning, complementing GLP-1’s appetite suppression.

2. Retatrutide (Eli Lilly)

- What it is: A weekly injectable targeting three receptors—GLP-1, GIP, and glucagon.

- Why it matters: Early trials suggest unprecedented efficacy, with participants losing up to 24% of body weight. This “triple agonist” could set a new gold standard.

2028 and Beyond: Bold Innovations and New Pathways

1. MariTide (Amgen)

- What it is: A monthly injectable that activates GLP-1 while blocking GIP signaling—a unique approach.

- Why it matters: Unlike drugs that stimulate GIP (like Zepbound), Amgen bets that inhibiting GIP could enhance weight loss. Early data shows promise.

2. Bimagrumab (Eli Lilly)

- What it is: An injectable blocking myostatin, a protein that limits muscle growth.

- Why it matters: It could help patients lose fat while preserving or increasing muscle mass—a game-changer for metabolic health and physical function.

3. Monlunabant (Novo Nordisk)

- What it is: A daily oral CB1 cannabinoid receptor inhibitor.

- Why it matters: Earlier CB1 drugs (like rimonabant) were shelved for psychiatric side effects, but Monlunabant aims to target receptors outside the brain, reducing risks.

The Bigger Picture: Trends to Watch

- Oral Options: Pills like Orforglipron and Monlunabant could democratize access to obesity care.

- Multi-Targeted Therapies: Drugs like Retatrutide and CagriSema highlight the shift toward combining hormonal pathways for amplified effects.

- Beyond GLP-1: Innovations like myostatin inhibition (Bimagrumab) or CB1 modulation (Monlunabant) explore entirely new biological pathways.

A Word of Caution

While these timelines reflect current estimates, approval dates may shift based on clinical trial results or regulatory reviews. Safety and long-term outcomes remain critical hurdles. Still, the diversity of approaches signals hope for personalized obesity treatments—pairing medication with lifestyle changes to tackle this complex condition.

Stay tuned: The next decade could reshape how we think about weight management, one breakthrough at a time.

—Follow for updates as these therapies progress through clinical trials and FDA review.

Reference: Nature